In this report

Credit unions and small banks: level up your CX expertise

Credit unions and small banks: level up your CX expertise

For decades, credit unions and small banks have tailored their offerings to customers and members. Loyalty came naturally. As long as funds remained FDIC insured and firms didn't make mistakes, consumers rarely changed their banks.

But times are changing, and small banks and credit unions are increasingly vulnerable. Most consumers who are open to or actively considering changing their bank would consider banking with a tech company if they could. In fact, roughly 40% of millennials and Gen Xers say they would open a fee-based Amazon checking account bundled with services like cell phone damage protection and ID theft protection for a monthly fee.

Companies today are faced with competing against their direct competitors and against the best experience a customer has ever had. It's a fundamental shift in how businesses go to market, influence their prospects, and engage with their customers.

The focus of this resource is to help credit unions and small banks navigate changing customer and member expectations successfully. We’ll go over how to drive revenue, reduce risk, and innovate faster.

Conquer a changing landscape

Digital is changing the industry

Whether member-owned or connected through a shared lifestyle or geography, small banks and credit unions tend to forge closer relationships with their customers and members than the average company. For one, they can’t afford to burn bridges, so they're used to taking steps to ensure repeat business. It’s in the DNA of small banks and credit unions to be customer-centric, and it's long been their key differentiator.

However, the growing digital landscape is making it easier for competitors to cater to consumers' changing attitudes and financial health needs. As more and more brands try their hand at snagging a piece of the financial services pie, it's getting harder for traditional players to keep up.

How do you maintain a high-touch, white-glove experience in the digital world?

More and more consumers are breaking away from the branch. Yet, their expectations for a seamless experience are staying the same or getting higher.

According to Forrester, delighting retail banking customers is complex. Three key emotions drive loyalty to financial organizations: feeling appreciated, respected, and valued. To translate that emotional connection to a digital experience is no small feat. How do you know what your customers want when they’re not visiting the branch as often, or even at all? How do you measure not only how often they visit your website, deposit a check via your mobile app, or call customer service, but how they feel about these experiences?

In his book Doing Digital: Lesson from Leaders, Chris Skinner agrees that today’s banking customers are harder to reach because digital relationships have replaced physical interaction. This doesn’t mean that you should close your branches and become an online bank. In fact, data shows that Gen Y consumers actually prefer in-person shopping experiences as opposed to millennials or Gen X. What it does mean is you need to have a strategy in place to learn how to anticipate every need of each of your customers and members.

According to Skinner, the solution is simple.

Embrace real digital transformation

Digital transformation is not a new concept in the finance world, but it’s one with which companies still struggle. Much like good CX is a moving target, so is digital transformation. Luckily for small banks and credit unions, the two overlap quite nicely.

According to Skinner, the key to digital transformation is to put your customers at the heart of it. He argues that there’s no point in even undertaking a digital transformation if you’re not planning to change the way your organization does business fundamentally. The end goal of a digital transformation is to become obsessively focused on your customer's problems and how to solve them.

And experts are precise about what digital transformation is and isn’t. Digital transformation isn’t the same as change. It’s not slapping a new look on old processes. It’s not segmenting product offers, customizing home page messages, or digitizing the existing member journey. It’s about adjusting your approach to look beyond offering products and instead focusing on consumer needs and expectations. Transforming into a customer-centric company is what will drive loyalty and advocacy and, in turn, market share and the financial health of your customers.

In fact, the riskiest thing a firm can do is nothing. If COVID-19 taught us anything, it's that organizations must pivot with their customers' needs and expectations or risk getting left behind. Unfortunately for many businesses, maintaining the status quo during a shifting economy was a losing strategy.

However, some firms were able to act fast by looking to their customers for answers.

For example, T. Rowe Price had to pivot quickly after launching a new online account creation process. When the company noticed a 37% drop-off rate on the first step of the web page, they knew the issue had to be solved quickly. But they didn't know why customers were dropping off.

After conducting tests in UserTesting, T. Rowe Price uncovered "the why" behind the drop-off and was able to fix the issue within hours of noticing it.

"UserTesting has totally changed the perception about user research being an expensive and time-consuming process."

Harsha Thayi

Sr. Manager, User Experience, T. Rowe Price

How great CX leads to customer loyalty

While taking a customer-first approach to business isn’t new, some companies are better at it than others. Elite brands do all the usual things you’d expect, like ensuring ease of use, aesthetics, trust, and efficiency. However, there are some key differentiators that raise the bar for great CX.

Customer-facing employees are key | Don't forget in-person experiences | Seamless omnichannel experiences |

A study by Temkin Group found that companies that deliver great CX have employees that are 1.5x more engaged than those who have less satisfactory CX. | According to a survey by A.T. Kearny, 81% of Gen Z consumers prefer to do their shopping in-store rather than online. Don't close down your branches just yet. | Being customer-centric means optimizing the entire customer journey. Is your CX an opportunity to earn loyalty rather than lose it? |

Once the focus is on your customers or members, not products or internal processes, you know you’re on the right path. Look at your interactions with your customers today and challenge them. Are you meeting their needs? Are you solving what they consider to be their biggest problem? How do you know?

Despite significant investment in digital tools and platforms, many organizations still struggle to meet evolving customer expectations. This persistent disconnect—known as the experience gap—arises from common issues such as a lack of timely customer feedback, internal misalignment, and a fundamental misunderstanding of user needs. While 87% of companies believe they deliver exceptional customer experiences, only 11% of customers agree. In today’s competitive landscape, closing this gap is essential—especially as companies that lead in customer experience grow their value at five times the rate of their peers.

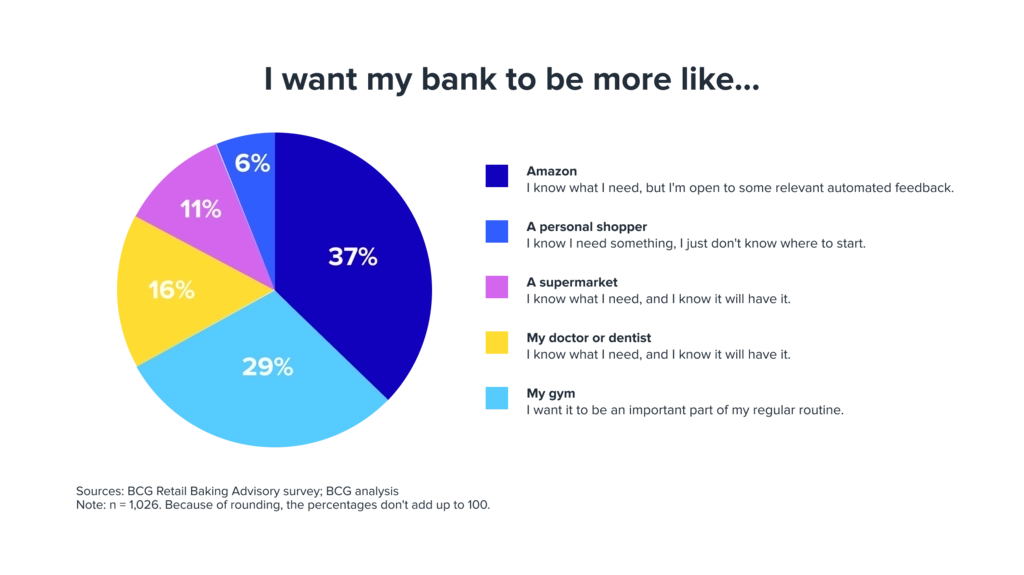

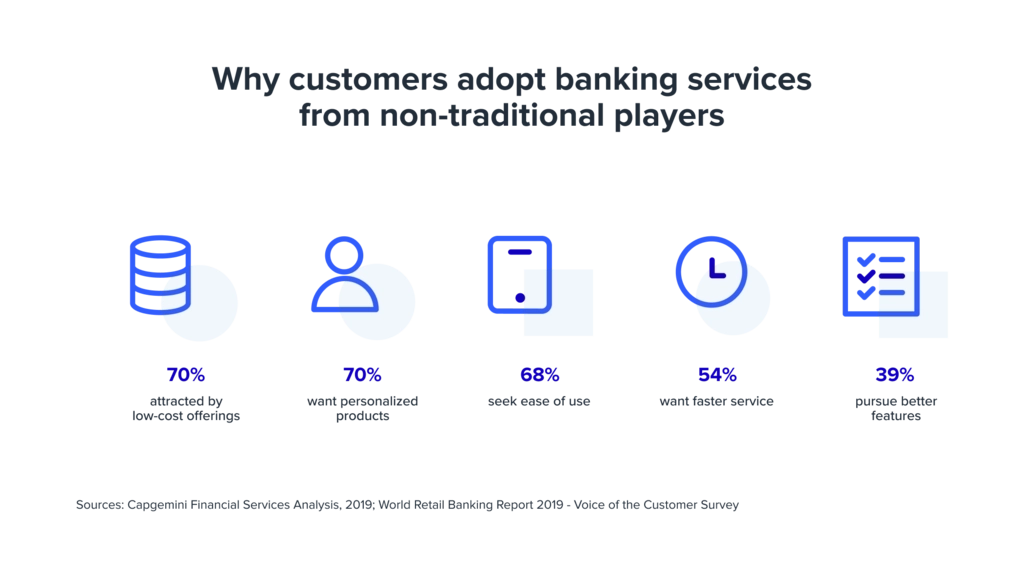

With more choice, CX is the deciding factor for whether companies survive or fail. Despite customers rarely switching bank providers, some are ready to exercise their power. Customers who are considering a switch are looking for low-cost offerings, personalized products, ease of use, faster service, and better features.

To avoid losing market share, your team must have a deep understanding of your entire customer journey, including all touchpoints. Whether online or in-person, whether you have control over them or not. This understanding will empower you to confidently assess where you can make changes that will have the biggest impact on customer loyalty.

Introducing customer empathy

Customer empathy is developing a deep understanding of your target audience and customers’ changing needs and expectations to ensure the experience you provide online and in-person consistently exceeds their expectations. For empathy to work, it has to be infused into your organization’s culture. While not a success metric, customer empathy is how you influence your success metrics. It's your company's north star.

Building empathy gives you a direct sightline into what customers want by gathering their feedback and opinions at the cadence of your choosing. Create a culture of empathy by sharing customer feedback across your organization. This gives business leaders, executives, board members, and other functional areas insight into customer needs. Gain stakeholders through changes implemented using customer feedback.

Empathy flourishes when customer and member needs are brought closer to decision-makers. With empathy, you can:

- Innovate faster by learning more about your prospects and customers, such as their pain points, then design solutions to meet their needs.

- Drive business growth by identifying low-lift areas where you'll see the highest ROI and impact.

- Reduce risk by investing in solutions that customers actually want versus spending money on things that don't lead to results.

Scaling customer empathy = scaling customer loyalty

Historically, geography decided a small bank or credit union’s customer or member base. Thanks to the digital age, consumers have more choices than they know what to do with. Your customers can be anywhere, anyone, and their loyalty is up for grabs. So, what does it take to earn it?

| ||

Optimize for different groups of customers | Adapt to new customers | Listen to every customer |

Finastra's financial services tool is used by 90 of the world's top 100 banks, so they have an extensive testing roadmap. Finastra shares video feedback from UserTesting company-wide during agile sprints, which allows for rapid iteration. | When TaxSlayer sought to make its platform more accessible for the average person, they used UserTesting to test new designs. A change to the website led to a 79% reduction in time on task and a 7.37% reduction in time on page year over year. | Before UserTesting, Experian obtained NPS feedback from power users, but not end-users who were getting left out of the decision-making process. Now, Experian collects feedback from all users, resulting in a 20% process improvement. |

How credit unions and small banks operationalize CX

When it comes to operationalizing a constantly moving target like CX, an excellent place to start is acknowledging your challenges. For small banks and credit unions, this includes:

- Procurement

- Managing an audience

- Security and regulation

Where to start?

Before you decide what to build, focus on the problem you want to solve. Interview customers, talk to customers about what they think their biggest problem is.

Once you’ve identified a customer need, you can start designing a way to fix it. However, you’re not done getting feedback from the customer just yet. Before you even decide what you’re building, you’ll want to get your idea, wireframe, or prototype in front of more of the target audience as early as possible in your process to make sure you're going in the right direction.

Incorporating feedback throughout your design or production cycles will help you address unexpected issues early in the process. Your benefits grow exponentially if you include getting feedback at every stage.

For example, ATB Financial learned how customers felt about a new website minutes after launch using UserTesting. They were able to iterate rapidly with informed decisions.

"UserTesting has helped us shape different products, campaigns, and ideas quickly, putting our customers front and center. We run studies roughly every week which are informing how we shape our platform and scale our business."

Jesús Ramirez

Sr. UX Manager, ATB Financial

Discovery

To determine what to build next, supplement business strategy, usage analysis, and instinct with a deep dive into customer and prospective customer interviews. Interview people in a market that you’re interested in learning more about. These interviews will provide you with a prioritized list of the most critical unmet needs, and the size of the market.

Map impact by determining one measure that matters for each team or initiative.

When you’re looking to educate others, don't tell them the results, show them. Use video feedback to reinforce the vision and roadmap so that everyone can move forward together with a shared understanding of your target customer.

Design and build

Once you have a clear understanding of the problem you’re trying to solve, start by showing your target audience some concepts. These could be static images, landing pages, written descriptions, or marketing collateral. This helps you narrow down the feature set and value proposition. As you increase your understanding and the fidelity of your solution, continue to test prototypes, both for usability, understandability, and value. When you’re close to launching a new product, test the live code with customers, and run betas.

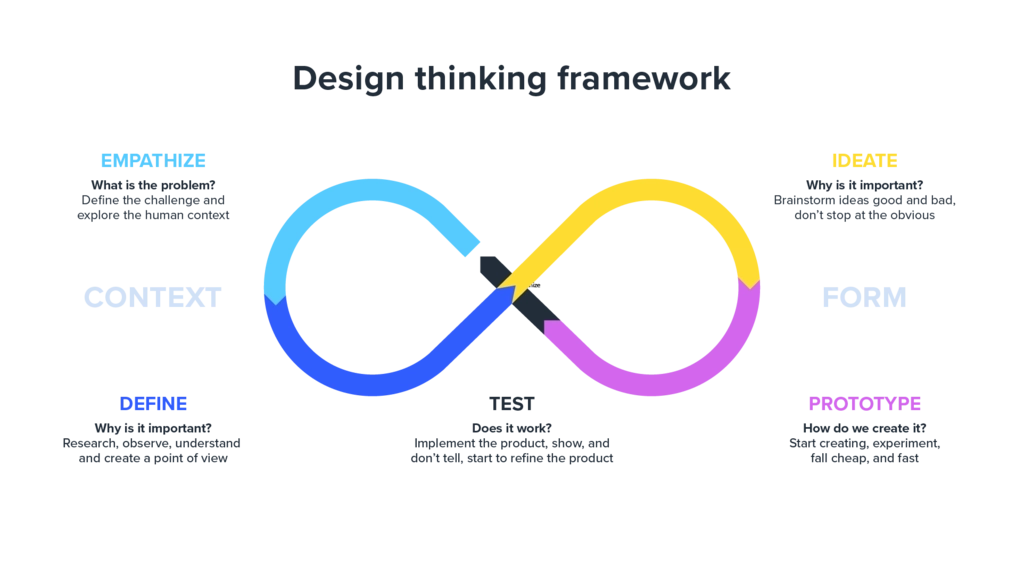

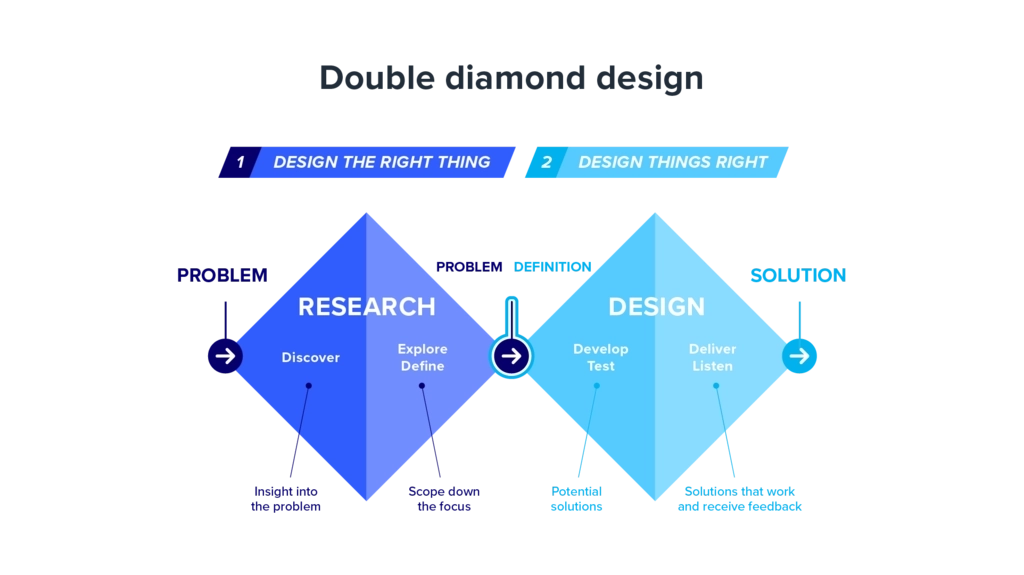

Align to the design framework the team is already using. Commonly used frameworks are:

Design Thinking

A human-centered approach to innovation that draws from the creator’s toolkit to integrate the needs of people, the possibilities of technology, and the requirement for business success. Regardless of the order you complete the stages, the most important stage is “empathize.” Customer empathy should inform everything your team does to ensure that your customer is the center of the experience.

Double diamond

A non-linear process for exploring an issue widely or deeply (divergent thinking) and then taking focused action (convergent thinking). The four principles of the double diamond are to put people first, communicate visually and inclusively, collaborate and co-create, and iterate, iterate, iterate. All of these steps help to keep the focus on the customer throughout your process.

Don’t forget to talk to non-customers too. These should be people in your target audience but not familiar with your offering or brand. This will help you avoid the curse of knowledge, a cognitive bias occurring when an individual, communicating with other individuals, unknowingly assumes that others have the background to understand. No matter how hard you try to put yourself in a first-time user’s shoes, it’s nearly impossible once you’ve been working on a product. Be sure to always get an unbiased perspective by collecting feedback from people from your target audience who aren’t already familiar with you.

Launch and evaluation

Once an experience has launched, track usage and customer feedback, consider conducting usability testing of the live product with people who have and haven’t had a chance to use it. All this leads to incremental improvements and feeds into the discovery phase for new ideas.

Be sure to show stakeholders the responses to the new product, idea, experience, or whatever it is you’ve created.

The ROI of great CX

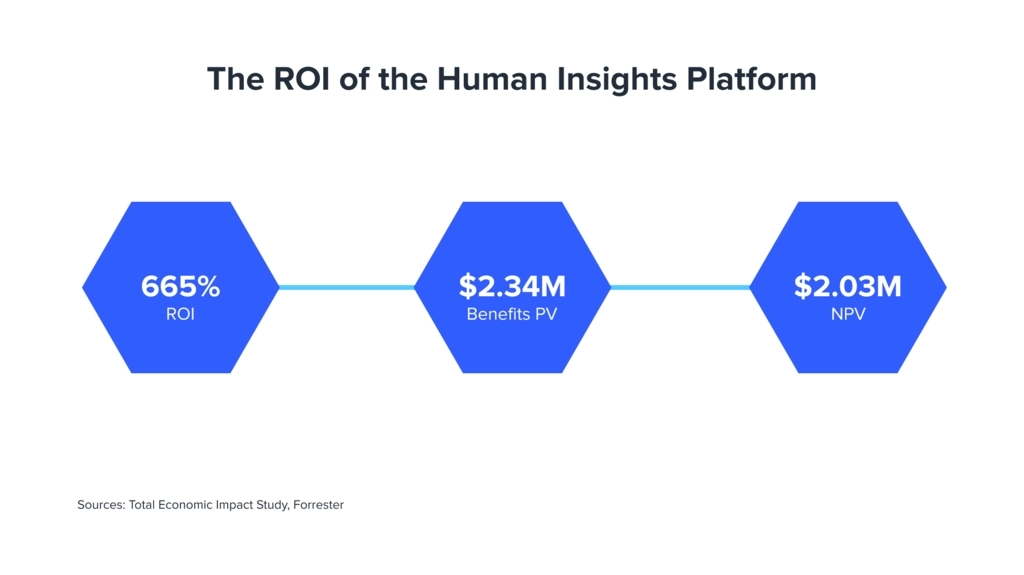

Forrester conducted a Total Economic Impact study with UserTesting to examine the potential return on investment businesses can realize by deploying the Human Insight platform to become a customer-centric organization. The risk-adjusted present value (PV) quantified benefits over a three-year investment and totaled $2.34M. Here are just a few of those benefits:

Profit from improved ease of use | Cost savings from customer-centric design cycles | Cost savings from time saved for marketing teams |

35% | 27% | 8% |

Additionally, there were several benefits of using UserTesting that were not quantified for the study:

- Elevated impact of customer insights - attributing profit improvements to the influence of qualitative insights elevated its position within the organizational hierarchy.

- Fostered a culture of empathy - spreading customer feedback enabled customer insights to reach more corners of the organization.

- Increased customer satisfaction - customer loyalty was a byproduct of increased customer satisfaction. Customers were having better experiences when their insights and feedback were taken into consideration and put into action.

- Provided business value from faster time-to-market - efficiencies in the design process translated to faster time-to-market for products and services.

Conclusion

While credit unions and small banks tend to be naturally customer-centric, the digital world is changing what that means. As we transition into an economy where consumers seek top-notch experiences, credit unions and small banks are competing against a slew of new contenders. Meanwhile, the coronavirus pandemic pushed the digital experience to the forefront. Luckily, your digital transformation plan and the best strategy to compete in the experience economy are the same–customer-centricity. After all, businesses aren't going customer-centric for no reason. There are real benefits and ROI for financial firms as well as the consumer.

"If we didn't have a tool like UserTesting, it would be really hard to understand how our customers are using our product. User research would be so much more expensive and time-consuming, too."

Shamraiz Gul

Sr. UX Lead, Finastra

Watch a demo

See how easy it is to get fast feedback on a website, prototype, design, or more in this demo.