In this report

Understanding evolving banking expectations

Understanding evolving banking expectations

We all know that consumers' habits are changing, but do we know how and why? Before making big decisions about the future of your financial organization, it's best practice to check in with consumers to find out what's going on behind their actions, the important details that get lost in digital exhaust—like customer motivations, needs, and expectations.

UserTesting commissioned a global survey of 3,800 consumers worldwide to learn the spending and banking habits of generations from the silent generation to Gen Z.

At a high level, we learned that, despite major technological advancements in digital banking, 27% of people globally still strictly use traditional banks, ditching digital-only completely—including 28% of baby boomers and 26% of millennials. In comparison, only 12% globally said they’d rather use a digital bank with no physical presence. Digital banking has its advantages, yet four in five digital bank users wished their banks offered some of the perks traditional banks already have—such as the 38 percent of them that wish digital banks offered the ability to talk to humans for customer support.

Learn more about how the different generations feel about their banking experiences and spending money:

- United States: 1,800 consumers surveyed

- Australia: 1,000 consumers surveyed

- United Kingdom: 1,000 consumers surveyed

The following reports are for anyone interested in getting a deeper understanding of what global consumers are experiencing.

United States

A third of people said they “strictly” use traditional banks, ditching digital-only completely

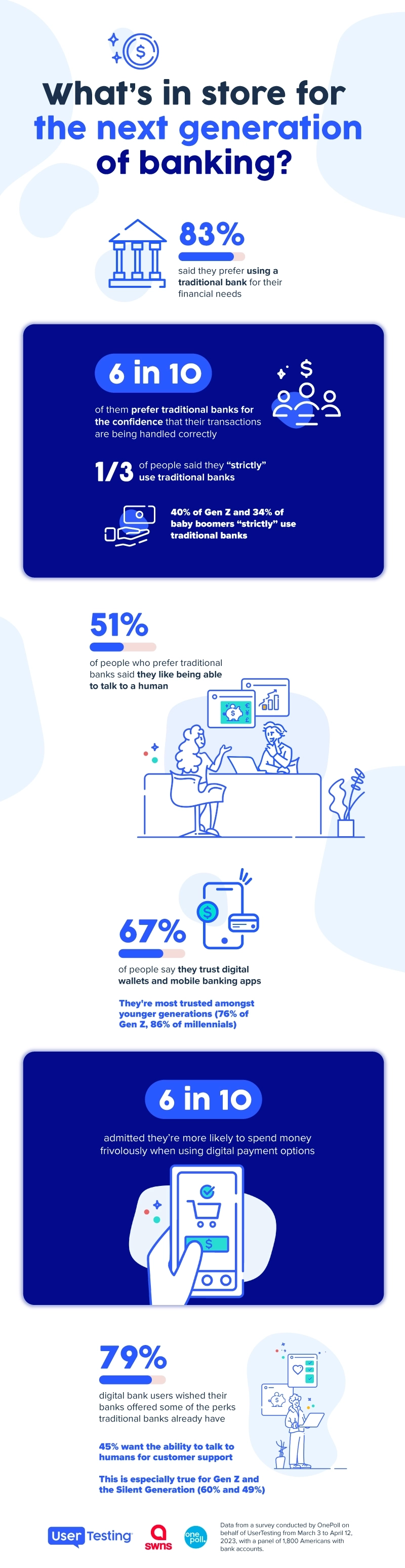

The study also revealed that when it comes to finances and banking, people across all generations prefer a human touch — 83% said they prefer using a traditional bank for their financial needs.

A third of people (36%) said they “strictly” use traditional banks, ditching digital-only completely—including 40% of Gen Z and 34% of baby boomers. In comparison, only 10% overall said they rather use a digital bank with no physical presence.

People who prefer traditional banks said they like having the confidence that their transactions are being handled correctly (60%) and being able to talk to a human (51%).

“We’re seeing a strange dichotomy in banking unfolding in front of us,” said Dana Bishop, VP of Experience Research Strategy at UserTesting. “We know physical banking branches are closing in droves, yet the data here support that consumers, especially in younger generations, crave the benefits that traditional banks provide. Digital banking platforms should consider this when implementing new services to meet these more human-oriented banking needs.”

While many said they prefer traditional banks, 67% said they still trust digital wallets and mobile banking apps – most popular amongst younger generations (76% of Gen Z and 86% of millennials) and least popular for baby boomers (48%).

Two in five (41%) prefer mobile payment apps to send money back and forth, and 53% do so up to five times per month.

Six in 10 (60%) also admitted they’re more likely to spend money frivolously when using digital payment options.

Four in five (79%) digital bank users wished their banks offered some of the perks traditional banks already have — such as the 45% who wish digital banks offered the ability to talk to humans for customer support.

Out of all the respondents surveyed, Gen Z rather talks to humans the most (60%), compared to the Silent generation (49%) and baby boomers (28%).

“In reality, there’s still an open space for hybrid institutions to exist,” continued Bishop. “Both digital and traditional banking platforms have their exclusive benefits, but there is a clear want and need for institutions to exist in both physical and digital worlds, providing the shared perks either can offer.”

Hear what respondents have to say.

Top 3 monthly budget spends per generation

Gen Z | Millennial | Gen X | Baby Boomer | Silent gen | ||||||

| 48% |

| 55% |

| 45% |

| 47% |

| 45% | |

| 2. Credit card debt | 41% | 2. Credit card debt | 46% | 2. Rent/mortgage | 38% | 2. Utilities | 43% | 2. Rent/mortgage | 43% | |

| 3. Rent | 39% | 3. Utilities | 44% | 3. Utilities | 38% | 3. Rent/mortgage | 31% | 3. Loans | 39% | |

48% of Americans polled said their grocery costs are eating up the majority of their monthly budget, followed by utility bills (38%) and credit card debt (37%).

Younger Americans are also focused on their financial positioning for the future. Thirty-eight percent of Gen Zers are delegating the majority of their monthly budget towards loans, while 46% of millennials are likewise spending most of their money tackling credit card debt.

Meanwhile, 45% of Gen X is spending the most on groceries, 43% of baby boomers are paying the most on utility bills, and 43% of the Silent Generation are forking up the most for their rent and/or mortgages.

Gen X is spending the most on groceries, while Baby Boomers are paying the most on utility bills

Enough talk about millennials and their avocado-toast-buying ways—new data suggests every generation is at risk of spending too much cash on their grub.

A poll of 1,800 US adults found, across the board, 48% said their grocery costs are eating up the majority of their monthly budget, followed by utility bills (38%) and credit card debt (37%).

Younger Americans are also focused on their financial positioning for the future. Thirty-eight percent of Gen Zers are delegating the majority of their monthly budget towards loans, while 46% of millennials are likewise spending most of their money tackling credit card debt.

Meanwhile, 45% of Gen X is spending the most on groceries, 43% of baby boomers are paying the most on utility bills, and 43% of the Silent Generation are forking up the most for their rent and/or mortgages.

United Kingdom

82% of UK adults prefer in-person banking experiences

Commissioned by UserTesting and conducted by OnePoll, the study also revealed that when it comes to finances and banking, people across all generations prefer a human touch—82% of UK residents said they prefer using a traditional bank for their financial needs.

Less than a fifth of UK residents (16%) said they “strictly” use traditional banks, ditching digital-only completely — including 27% of the silent generation and 22% of baby boomers. In comparison, only 15% said they’d rather just use a digital bank with no physical presence, and 66% said they use both traditional and digital banks.

People who prefer traditional banks said they like speaking with a human (43%), and 35% like having a physical place to go.

“We’re seeing a strange dichotomy in banking unfolding in front of us,” said Dana Bishop, VP of Experience Research Strategy at UserTesting. “We know physical banking branches are closing in droves, yet the data here support that consumers, especially in younger generations, crave the benefits that traditional banks provide. Digital banking platforms should consider this when implementing new services to meet these more human-oriented banking needs.”

While many said they prefer traditional banks, 55% said they still trust digital wallets and mobile banking apps – most popular amongst the more middle-aged generations (64% of Gen X and 60% of baby boomers) and least popular for the silent generation (38%).

Only three in 10 prefer to conduct a money transfer as the most popular way of sending money back and forth, and 77% transfer money up to five times per month. 22% admitted they’re more likely to spend frivolously using digital payment options.

Seven in 10 digital bank users wished their banks offered some of the perks traditional banks already have—such as the 27% of them that wish digital banks offered the ability to talk to humans for customer support, and 23% wish their banks had better card perks or rewards.

Out of all the respondents surveyed, the silent generation preferred talking to humans the most (57%), followed closely by the baby boomers (51%), and compared to millennials (30%), which had the least interest in speaking with humans.

“In reality, there’s still an open space for hybrid institutions to exist,” continued Bishop. “Both digital and traditional banking platforms have their exclusive benefits, but there is a clear want and need for institutions to exist in both physical and digital worlds, providing the shared perks either can offer.”

Hear first-hand what UK participants have to say.

Top 3 monthly budget spends per generation

Gen Z

| Millenial

| Gen X

| Baby Boomer

| Silent gen

|

The UK's oldest and youngest residents are spending the most on groceries

Prices for food and non-alcoholic drinks have been rising at the fastest rate in 45 years in the UK, according to the most recent cost of living latest insights by the UK’s Office of National Statistics.

This survey highlights that for the older generations across the United Kingdom, 74% of the silent generation and 66% of baby boomers account for groceries as the highest expenditure in their respective budgets. Similarly, Gen Z’s highest spending is on groceries at 48%. Meanwhile, 6 in 10 Gen X residents state groceries are their second-highest budgetary item after utilities.

56% of millennials claim rent or mortgage as their highest budget item. Utilities are also high for other UK residents, including 59% of the silent generation listing utilities as their second most expensive budgetary item, and the same holds for 58% of baby boomers.

Australia

83% of Australian adults prefer in-person banking experiences

Commissioned by UserTesting and conducted by OnePoll, the study also revealed that when it comes to finances and banking, people across all generations prefer a human touch—83% of Australians said they prefer using a traditional bank for their financial needs.

A fifth said they strictly use traditional banks, ditching digital-only completely— including 29% of baby boomers and 27% of the silent generation. In comparison, only 14% overall said they rather use a digital bank with no physical presence, and 62% said they use both traditional and digital banks.

People who prefer traditional banks said they like speaking with a human (44%), and 39% like having a physical place to go.

“We’re seeing a strange dichotomy in banking unfolding in front of us,” said Dana Bishop, VP of Experience Research Strategy at UserTesting. “We know physical banking branches are closing in droves, yet the data here support that consumers, especially in younger generations, crave the benefits that traditional banks provide. Digital banking platforms should consider this when implementing new services to meet these more human-oriented banking needs.”

While many said they prefer traditional banks, 45% said they still trust digital wallets and mobile banking apps – most popular amongst younger generations (53% of Gen Z and 52% of millennials) and least popular for baby boomers (36%).

Only three in 10 prefer to conduct a money transfer as the most popular way of sending money back and forth, and 72% transfer money up to four times per month. Only 21% admitted they’re more likely to spend frivolously using digital payment options.

73% of Australian digital bank users wished their banks offered some of the perks traditional banks already have—31% of them wish digital banks offered the ability to talk to humans for customer support, and 26% wish their banks had physical ATMs or waived ATM fees.

Out of all the respondents surveyed, the silent generation prefers to talk to humans the most (60%), compared to the baby boomers (46%) and millennials (42%), with Gen Z being the least interested in speaking with humans (29%).

“In reality, there’s still an open space for hybrid institutions to exist,” continued Bishop. “Both digital and traditional banking platforms have their exclusive benefits, but there is a clear want and need for institutions to exist in both physical and digital worlds, providing the shared perks either can offer.”

Hear first-hand what participants had to say.

Top 3 monthly budget spends per generation

Gen Z

| Millenial

| Gen X

| Baby Boomer

| Silent gen

|

Australian residents are spending the most on groceries

Costs for food and non-alcoholic beverages for Australians increased by 9.4% from Nov. 2021 through Nov. 2022, according to the Australian Bureau of Statistics. In that same article, referring to 2023, it stated, “While food prices are not expected to soar, prices overall are not expected to fall.” This survey highlights that for the older generations across Australia, 77% of the silent generation, 73% of baby boomers, and 65% of Gen X still account for groceries as the highest expenditure in their respective budgets.

Meanwhile, 59% of millennials claim rent/mortgage as their highest budgetary item, and 59% of Gen X state rent or mortgage as their second highest budgetary expense. Gen Z, however, follows in the footsteps of their senior counterparts, with 49% identifying groceries as their highest budget expense.

The future of banking contact centers

Discover key trends shaping the future of banking contact centers and how to improve customer experience.