In this guide

Retail banking: boost your customer experience

Retail banking: boost your customer experience

During the COVID-19 pandemic, traditional banks became keenly aware of the importance of customer empathy. According to Forrester's Banking Predictions Report, they did a great job of gaining consumer trust by reaching out to and preparing customers for risk. Yet, just a few years later, consumer trust in banks is dropping, according to the same report.

Research from Forrester recommends that banks continue to lead with empathy as they did during the pandemic and take a data-driven approach to maintain and earn consumer trust with concrete, targeted actions that help consumers navigate the cost-of-living crisis.

This guide will cover an important strategy for retail bank leaders to improve their customer experience and stay competitive using human insight.

Leading with empathy increases customer confidence

Getting closer to your customers is always a sound business strategy, but it’s critical during tough economic times.

Rising interest rates and challenges from digital banks are increasing customer acquisition costs, making revenue growth from existing customers more important than ever. It's no wonder that customer trust is becoming a C-level priority. Look at your interactions with customers today and challenge them:

- Are you meeting your customer’s needs?

- Are you solving what they consider to be their biggest problem?

- Are you fostering a close relationship with them?

- How do you verify?

Let’s talk about how to improve your customer experience by making customer-centric business decisions.

There's a bit of magic that starts to happen after teams spend time one-on-one, or one with many, with a group of customers. They start to develop an empathy for the end user and an intuition around the problems they have and how we could solve that really well.

Nilan Peiris

VP of Growth, Wise

Level up customer confidence and trust: empathy

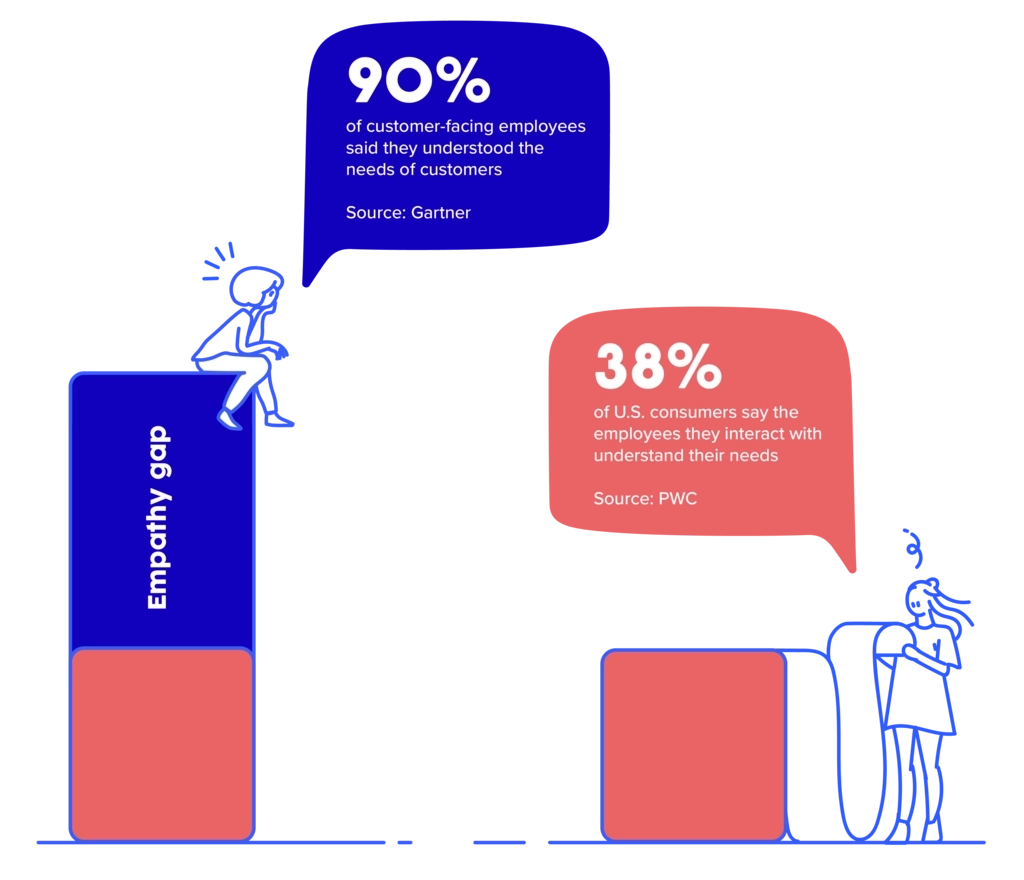

Many organizations suffer from what’s been coined the empathy gap. Studies by Gartner and PwC, respectively, found that while 90% of customer-facing employees said they understood the needs of their customers, only 38% of consumers feel the employees they interact with understand their needs.

With more choices available, customer experience decides whether companies survive or fail, and banks aren’t immune. In the past, customers rarely switched bank providers and viewed them more as a utility. Today, consumers are learning to exercise their power of choice as more options become available. According to PwC, 32% of customers will abandon a brand they love after a single bad experience, and 59% will walk away after several bad experiences.

So what can you do about this?

After consistency, dependability, and accountability, empathy is the fourth lever in Forrester’s Global Trust Imperative Survey for banks and large financial organizations. They gain customer empathy by developing a deep understanding of their customer's changing needs and expectations to ensure the experience they provide online and in-person consistently exceeds expectations.

Empathy flourishes when customer needs are brought closer to decision-makers via human insight data.

With customer empathy, you can:

- Discover customer needs early by giving teams access to speak with and learn from customers directly.

- Innovate faster by learning how current and future customers perceive financial value in their own words.

- Drive business growth by identifying low-lift areas with the highest ROI and impact.

- Reduce risk by investing in products, offers, and services that improve customers' lives versus spending resources on initiatives that flop.

Today, the Customer Experience Professionals Association says customer experience is the perception people form of a business “based on interactions across all touchpoints, people and technology over time.” To avoid losing market share to challengers, your team must deeply understand the customer journey, including all touchpoints.

For example, Tesco Bank prides itself on helping customers make smarter decisions daily with their money. UserTesting was pivotal in helping them develop a “round up” savings program. The program allows Tesco customers to round up their change owed following a purchase and transfer it to a savings account.

With the Human Insight Platform, Tesco Bank identified that customers wanted to feel more confident about their finances. Then they validated that the round up program would effectively achieve that goal and that customers would enjoy using it.

Listen to Tesco Bank tell how talking to customers helped them design a successful new program.

How to do it

It’s easy to say customer empathy is important, but where do you start? It turns out that one of the biggest predictors of customer experience success is customer exposure hours. That’s the number of hours your team spends interacting with customers. Teams that spend a minimum of two hours every six weeks listening to customers see far greater outcomes than teams that don’t.

And we’re not talking about interviewing customers at a local branch, although that’s not a bad idea. With the Human Insight Platform, any team at your organization can easily watch recorded videos of current and potential customers answering question prompts and interacting with your digital experience.

To give you an idea of what the video results look like, we set up this quick test and asked some general consumers to tell us about their current bank. We asked them to rate their level of agreement with the following statement: I feel like my bank understands me.

Here are some of the responses we got compiled into a highlight reel.

How does it feel watching real consumers speak about their experience with their bank? While it’s one thing to understand that customers think of banks as transactional establishments, it’s another to hear it from them first-hand. Most of the responses we got were neutral or negative sentiments. The one positive sentiment was because the person experienced personalization in the mobile banking app. We’ll get to this later.

It’s a powerful tool to take video feedback from real people and show it to leadership and the broader organization. When people see customers' faces and hear real stories firsthand, they learn more about the customer experience than an NPS score could teach them.

Human insight becomes the glue that helps us take ideas and concepts and turn them into business value.

Andy Dykes

Design Principal, Tesco Bank

Level up customer confidence and trust: consistency

According to Forrester’s Global Trust Imperative Survey, consistency is the most impactful lever for building trust for banks and large financial organizations. Consistency is the expectation that an organization will always behave similarly so that individuals can confidently rely on the expected behavior or performance in their plans, actions, and assumptions.

Your organization’s engagement with customers, whether through employees at a branch, or an invisible third-party partner, can make or break their trust in you. So a consistent customer experience is another great place to start when assessing and optimizing trust in your organization.

One of the easiest ways to accomplish a consistent customer experience is by benchmarking your digital experience, such as your website and mobile app. You can do this proactively by using an insight platform to view customers completing common tasks like making a transfer online or signing up for a new service. Seeing firsthand what customers have trouble with or what they enjoy allows you to optimize your experience and make it better over time.

Another method is to let conventional analytics alert you to a problem and use the platform to pinpoint exactly what’s happening.

For example, T. Rowe Price had to pivot quickly after launching a new online account creation process. When the company noticed a 37% drop-off rate on the first step of the web page, they knew the issue had to be resolved quickly. But they didn't know why customers were dropping off during the process. After watching video feedback from UserTesting’s Human Insight Platform, T. Rowe Price uncovered why customers were dropping off and quickly fixed the problem within hours of noticing it.

Listen to T. Rowe Price explain how they quickly triaged an underperforming web feature.

How to do it

A great option for financial teams just starting out is to use pre-built templates. UserTesting templates are test layouts designed by research experts, complete with pre-written tasks and questions, so that non-research teams can quickly get the answers they need. Templates can be used as-is to guide you—or customized to fit your needs.

Digital experience templates

Branch experience templates

Getting to know your audience templates

Turn customer confidence into loyalty

For customer empathy to work, it has to be infused into your organization’s culture. It's your north star. This deep understanding allows your teams to confidently make changes that will impact the customer experience in a meaningful way.

Creating customer loyalty isn’t about slapping a new look on old processes. It’s not segmenting product offers or digitizing the current customer journey. It’s about adjusting your approach to look beyond products. It’s about spotlighting consumer needs and solving their problems. Transforming into a customer-centric culture is what will drive loyalty and advocacy.

Personalize your digital experience

Consumer appetite for digital personalization is picking up (Forrester Consumer Banking Trends Report). More than half of online adults in the US and UK want alerts to help avoid an overdraft or an upcoming expense. More than a third want financial health scoring tools or insight based on their spending patterns. How does your organization plan to compete with the elite customer experiences available? One way would be prioritizing personalization to make customers feel connected. Another way is by solving the real needs of consumers.

Listen to Wise share how they bring empathy to a numbers-driven organization.

Solve the needs of consumers

In 2023, banks are expected to redirect 60% of innovation spending to tangible, real-world innovation (Forrester Banking Predictions Report). This means focusing on automation and efficiency instead of more future-looking innovations. But organizations shouldn’t digitize blindly. Offering products and services that customers need is the second most influential driver of loyalty for US multichannel banks.

Don’t fall into the trap of automating things that customers enjoy, like hybrid experiences. Forrester data reveals that hybrid customer experience outperforms purely digital and physical. To deliver great hybrid experiences, banks must design emotionally attuned journeys and connect insight and decisions across all channels. A truly customer-centric culture can help achieve this.

We use UserTesting across different projects that are shaping our digital ecosystem which we will use to scale business and everyday banking services.

Jesús Ramirez

Senior UX Manager, ATB Financial

How to do it

A common way organizations ensure that everyone is on the same page in terms of customer experience is by hosting regular watch parties where they play customer feedback videos.

Collectively observing and analyzing customer videos is a great exercise for your organization to understand your customer better.

If you’ve ever tried to describe a movie to someone who hasn’t already seen it, there’s usually a point at which you say, “I guess you just had to be there.” And it’s true. A change in tone, a long pause, or even background noise can tell you a lot about a customer and their situation that can’t always be conveyed in an executive summary.

Nothing gets lost in translation when your team watches user testing videos together. Everyone was there for the experience. This is important because it gives the feedback context and puts the user front and center, keeping the human element part of the process—not just a number on a spreadsheet.

Additionally, there’s a vulnerability to watching customer feedback videos. Hearing the hard truth can be humbling, or even scary when a participant says something that goes against a strongly held internal belief. However, this is exactly what creates customer empathy, and doing it together as a group allows for a transparent and open discussion.

Check out this webinar on how to share customer insights throughout your organization for more information on running watch parties.

Better customer experience leads to 665% ROI in 3 years

While fostering customer empathy to boost customer experience is a no-brainer, it’s worth quantifying the return on investment. However, calculating the organizational cost of uninformed decisions leading to poor outcomes is not an exact science. That’s why Forrester conducted a Total Economic Impact study with UserTesting to examine the potential return on investment organizations can realize by deploying the Human Insight platform to become a customer-centric organization.

To better understand the benefits, costs, and risks associated with this investment, Forrester interviewed five customers with experience using the Human Insight Platform. The experiences of the interviewed customers were aggregated and combined into a single composite organization for the purposes of this study.

The customer interviews and financial analysis found that a composite organization experiences benefits of $2.34 million over three years versus costs of $305,730, adding up to a net present value (NPV) of $2.03 million and an ROI of 665%. Here are the details from the assessment of UserTesting’s value.

- Increases conversion rates by 0.5% each year from improved ease of use. UserTesting insight influences digital properties and marketing materials to make them more discoverable and accessible. Customers find what they’re looking for and move through the sales funnel more easily. For the composite organization, the resulting profit improvement totals $812,700 for the three-year investment.

- Increases annual spending by $7 on average from better enrichment loyalty. Using insight to inform design decisions makes it easier for customers to engage in buying behavior and fosters more brand loyalty. Customers feel heard, see more of what they want, and spend more yearly. For the composite organization, the resulting profit improvement totals $384,400 for the three-year investment.

- Enables an average two-week reduction in development cycles due to increased alignment. Influencing design cycles with customer insight align stakeholders and expedite decision-making processes. Additionally, it produces better results that reduce the amount of rework involved. For the composite organization, these efficiencies result in $627,500 in cost savings for the three-year investment.

- Saves 50% of time spent on material creation for marketing teams. As marketing teams leverage the UserTesting platform, they see additional productivity savings. Customer insight hones the marketing material creation process by streamlining decision-making and reducing rework cycles. For the composite organization, these efficiencies result in $176,700 cost savings for the three-year investment.

- Avoids 70% of costs previously associated with lab testing. Previous lab testing methods were expensive and time-consuming. For the composite organization, the cost savings from avoided lab research totals $336,500 for the three-year investment.

Several additional benefits also contribute to a high ROI:

- Elevated impact of customer insight

- Fosters a culture of empathy

- Increases customer satisfaction

- Faster time-to-market

Optimize faster | Improve for all | Listen to everyone |

Finastra's financial services tool is used by 90 of the world's top 100 banks, so they have an extensive testing roadmap. Finastra shares video feedback from UserTesting company-wide during agile sprints, which allows for rapid iteration. | When TaxSlayer sought to make its platform more accessible for the average person, it used UserTesting to test new designs. A change to the website led to a 79% reduction in time on task and a 7.37% reduction in time on page YoY. | Before UserTesting, Experian obtained NPS feedback from power users but not end-users who were getting left out of the decision-making process. Now, Experian collects feedback from all users, resulting in a 20% process improvement. |

Invest in customers for long-term success

Moving forward, large financial organizations mustn’t fall back into old habits. The path forward will look different than it has in the past. You may have gotten where you are today by investing in your organization, but long-term success comes from investing in your customers.

Remember the customer experience you worked hard to build during the pandemic. Continue leading with empathy and putting your customer’s needs first. Retain customer loyalty by catering to their changing needs.

Invest in your customers, connect your teams to customers, and put customers at the center of your decision-making.

Watch a demo

See how easy it is to get fast feedback on a website, prototype, design, or more in this demo.